|

|

November 12th, 2024: Officer Daniel McEvoy dropped in to take care of paperwork. He was graciously greeted by the Office of Retirement - K9 Koda. |

|

|

|

|

|

June 18th, 2024: Mr. Paul Vetter and his wife Madeline received a warm welcome during their visit with the Office K9 - Koda! Paul said he'll be back to get his Koda fix again real soon. |

|

|

|

|

|

May 17th, 2024: Mr. Brendon Vavrica of Mariner Institutional (formerly - AndCo Consulting) was recognized as the Service Provider of the Year for the Hollywood Police Officers' Retirement System. Mr. Vavrica's role on the team is the Board's Investment Consultant. Job well done Brendon, keep up the great work! |

|

|

|

|

|

May 17th, 2024: Mr. Brendon Vavrica of Mariner Institutional (formerly - AndCo Consulting) was recognized as the Service Provider of the Year for the Hollywood Police Officers' Retirement System. Mr. Vavrica's role on the team is the Board's Investment Consultant. Job well done Brendon, keep up the great work! |

|

|

|

|

|

February 16th, 2024: Mr. Kevin Campbell and Mr. Eric Wilcomes of Taurus Private Markets (PE) provided an update of the Taurus Private Markets Fund II, LP. The City of Hollywood Police Officers' Retirement Plan made an $8 million commitment. $800,000 of this commitment has been contributed to date (10.0%). Mr. Campbell expects another call capital in Q1 2024. Taurus Private Markets Fund II, LP has $211.6 million of investor commitments. 37.8% of fund capital has been committed to private equity partnerships and co-investments. Completed investments with 8 private equity managers and 1 co-investment:

4 leveraged buyout managers

3 venture capital managers

1 private credit manager

1 co-investment

The representatives feel that there is still a strong pipeline of investment opportunities.

To learn more about the firm, visit: TaurusPrivateMarkets.com. |

|

|

|

|

|

February 16th, 2024: The Board of Trustees presented Cathy Marano, Board Secretary with a token of appreciation, for her tireless effort as a Trustee of the Board for the last 25 years. Thank you Cathy for your commitment to the Plan. Congratulations on your retirement after 30 years on the department.

|

|

|

|

|

|

January 26th, 2024: Mr. Ryan Nail, CFA from Eagle Asset Management reported on the Small Cap Core portfolio. It was reported that Eagles returns outpaced the Russell 2000 Index on all measured time periods dating back to their inception of January 08, 2003. The Trustees commented that accomplishment was stellar, particularly based on their long term tenure of 21 years.

|

|

|

|

|

|

December 22nd, 2023: The Board of Trustees presented Laurette Jean a token of appreciation for her time as the City Liaison to the System. Ms. Jean recently left the city and will be sorely missed.

|

|

|

|

|

|

November 17th, 2023: Mrs. Janna Hamilton & Mr. Benjamin D. Monkiewicz of Garcia Hamilton & Associates presented a Bond Portfolio update to the Board of Trustees.

|

|

|

|

|

|

October 27th, 2023: Mr. Nick Rojo of Affiliated Housing Impact Fund provided a real estate update. Further details about the firm may be viewed at: AffiliatedDevelopment.com.

|

|

|

|

|

|

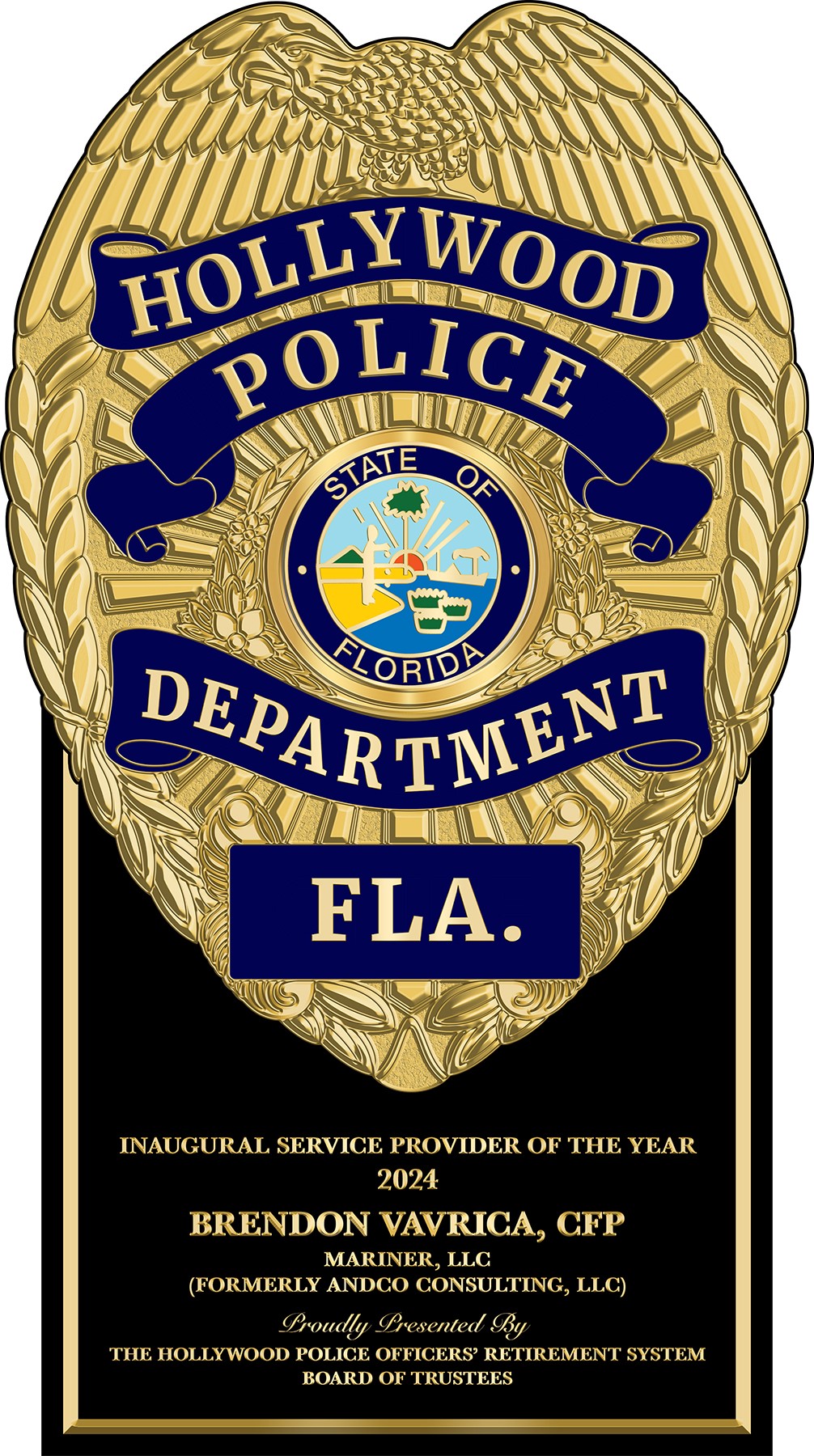

October 27th, 2023: Mr. Jack O'Callahan (Pictured) & Mr. Daniel Skubiz of Ziegler Capital Management provided a product review for the MVP Small Cap Core strategy. A firm overview was detailed to the Board. Ziegler focuses on a company's Cash Flow Return on Investment (CFROI) as the best way to measure wealth creation for new investment and valuation Discovery. Seasoned sector specialists with considerable tenure use their fundamental knowledge to interpret CFROI assumptions impact on a company's performance. Ziegler derives their own CFROI when forecasting the future for companies and stock price potential. Using CFROI to evaluate corporate performance to:

Evaluate long-term historical performance of a company's management team.

Identify changes in Operating Drivers: Sales, Margins, and Asset Turns.

Forecast future CFROI expectations.

Calculate current intrinsic value by discounting cash flows.

The Board of Trustees engaged Ziegler for an 8 million dollar mandate.

NOTE: John J. "Jack" O'Callahan is an American former professional ice hockey player who played 390 National Hockey League (NHL) regular season games between 1982 and 1989 for the Chicago Blackhawks and New Jersey Devils. Before turning professional, he was a member of the 1980 Winter Olympics United States national team that upset the Soviet Union in the "Miracle on Ice" game. |

|

|

|

|

|

February 17th, 2023: Mr. Alexander Hahn & Mr. Stephen Day of Capital Dynamics provided a brief update of the portfolio. State of the Secondaries Market was reported as follows:

Pricing continues to fall, mirroring the public market.

Market dislocation and declining public markets have resulted in a significant drop in secondary pricing to an about 80% average as of year-end 2022. Softening of pricing suggests that buyers are increasingly pushing back in the face of higher NAVs.

CD View: The discounts are wider than weve seen since the Great Financial Crisis. Some optimism in certain pockets of the market are proliferating as the markets seem to bounce back, but we see macro conditions continuing to exhibit instability with the potential for pricing to continue falling over the next couple of quarters at least.

Deal volumes are the second-highest on record.

Despite challenging economic conditions, secondary transaction volumes topped USD 110 billion, the second-highest year on record and evidence of the secondary market's resilience.

CD View: Drops in public markets are creating a denominator effect for many portfolios, and while it's not necessarily creating a panic sale environment, it will continue to bring more LP deals (in particular institutional) into the market over time fueling deal flow and ultimately volumes in 2023.

LP ⁽¹⁾ - led portfolio sales gain favor.

LP deals comprised 66% of the secondaries market in H1 2022, but by the end of the year only comprised just over half of the market, falling back in line with pre-pandemic volumes.

Despite this rebalancing, LP-led deals continue to be attractive to LPs as they seek options for active portfolio management and administrative relief.

CD View: The denominator effect could lead to a higher volume of LP positions coming to market in 2023. This could be even further exacerbated as private market valuations remain elevated.

GP ⁽²⁾ remain attractive for well-positioned buyers.

GP-led deal activity in 2022 remained resilient and reached nearly USD 50 billion, most of which consisted of single or multi-asset transactions. But demand for GP-leds remains strong as GPs continue to face duration issues as the extended holding periods for underlying companies are driving liquidity needs.

CD View: We currently (and expect to continue to) see GP-leds displacing traditional M&A, IPO and sponsor-to-sponsor sales. Given the macroeconomic uncertainty and scarcity of capital, recent GP-led deals that we have seen typically include very high quality portfolio companies and involve blue chip sponsors.

The secondary market remains undercapitalized.

The dry powder to market volume multiple (capital overhang) is sitting below 1.5x, the lowest level in several years, and under pressure as fundraising declines.

CD View: As this growing dry powder chases the similarly increasing supply of LPs portfolio allocations coming to market, our focus on the smaller end of the market, coupled with our ability to be selective, allows us to capitalize on the supply-demand imbalance that yields attractive buying opportunities.

Global Secondaries VI Update:

Investments & Pipeline

GSEC VI has closed 12 projects with another 2 in execution totaling over USD 250 million in commitments.

Projects are largely global and diversified by strategy, and offer exposure to high quality managers and companies.

A number of deals have been sourced on a proprietary basis or negotiated exclusively either through Capital Dynamics own platform or members of the Secondaries team.

Given the market volatility, we have been able to achieve meaningfully larger discounts than even the recent past.

Secondaries Market Dynamics

Despite challenging economic conditions, secondary transaction volumes topped USD 110 billion, the second-highest year on record and evidence of the secondary market's resilience.

Market dislocation and declining public markets have resulted in a significant drop in secondary pricing to an about 80% average as of year-end 2022.

The dry powder to market volume multiple (capital overhang) is sitting below 1.5x, the lowest level in several years, and under pressure as fundraising declines.

⁽¹⁾ - LP-led transactions are one-off transactions led by one limited partner in a fund looking to sell one or more limited partnership interests at some point during the life of the fund.

⁽²⁾ - A general partner (known as a "GP") is a manager of a venture fund. GPs analyze potential deals and make the final decision on how a fund's capital will be allocated. General partners get paid through management fees, carried interest, and distributions from the fund. |

|

|

|

|

|

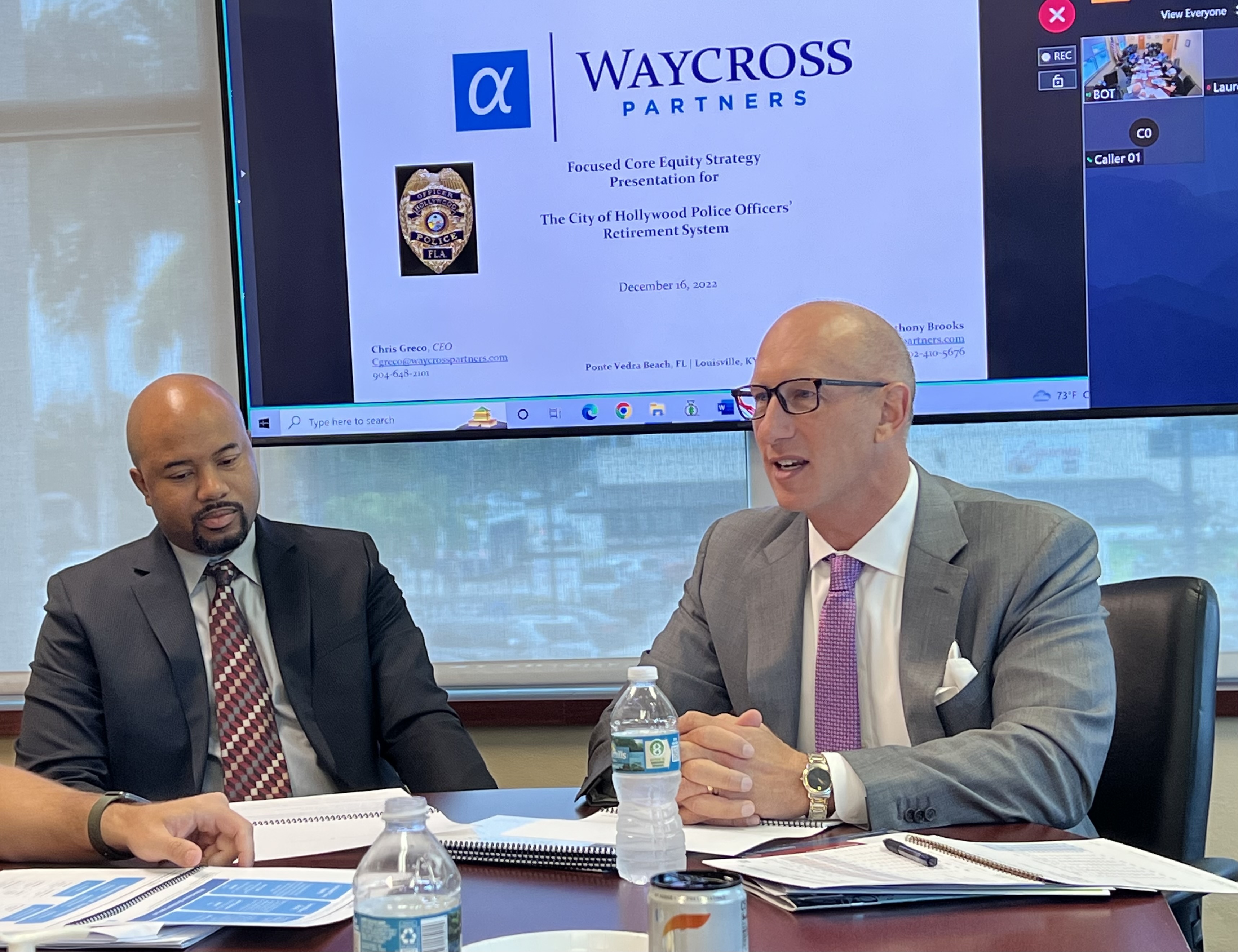

December 16th, 2022: The Board of Trustees received an investment presentation from Waycross Partners. The Board thanks the representatives, Mr Anthony Brooks and Mr Chris Greco for a thought provoking presentation.

|

|

|

|

|

|

March 25th, 2022: Mr. Dann Smith Allspring Director, Client Relations & Development (Pictured Left) & Mr. Bryant VanCronkhite, Allspring CFA -Managing Director and Senior Portfolio Manager, Special Global Equity joined the Board this date. Allspring Global firm review was provided since the separation from Wells Fargo. It was reported that Allspring's emphasis is on the balance sheet of the company they are investing in and Income statement. Allspring's approach minimizer's downside/maximize long-term opportunity. Target long-term above-peer performance with below-peer risk. As of December 31, 2021, the account balance was $49,490,677.89. Since inception (05/12/2015) the portfolio outpaced the benchmark by 94 basis points. Speaking for the Board of Trustees, Mr. Strauss thanked the team for the outstanding job and told them to keep up the great work!

|

|

|

|

|

|

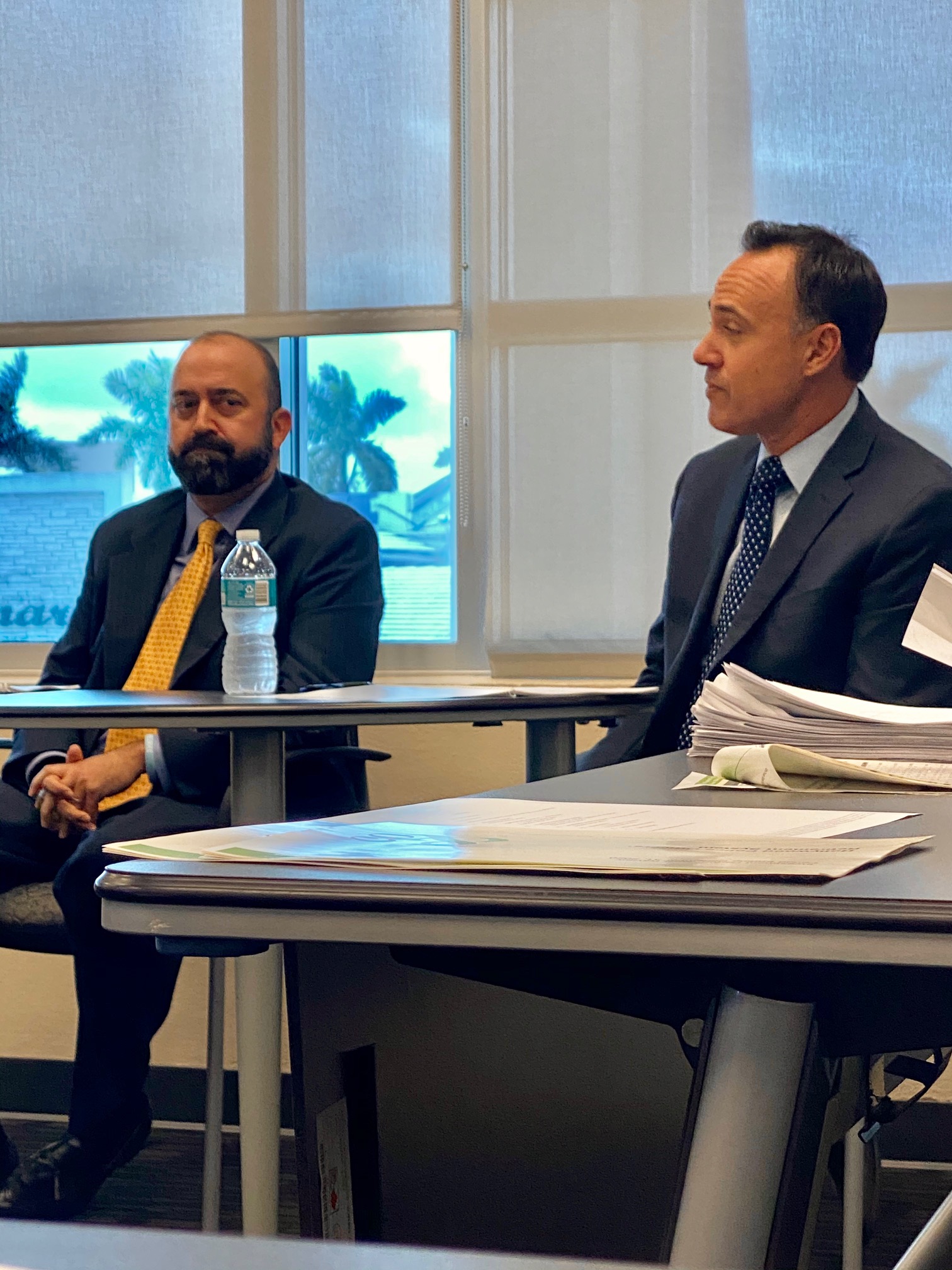

March 25th, 2022: Mr. John Rochford, Tocqueville came before the Board to update them on the Fixed Income Portfolio. Present positioning is 33% of Treasuries mature in 2023 & 2025 - average coupon 2.93%. 14% of Corporates mature in 2023 & 2024 - average coupon 3.125%. The portfolio has been positioned for the current events since January 2021. Future look - The Federal Reserve will, in our opinion, raise rates and reduce its balance sheet by selling Treasuries & Mortgages. We expect to begin gradually reinvesting in single A rated corporate bonds at 3.50%. We look to capture 4% + coupons over the remainder of 2022 with the majority of the 2023 to 2025 maturities.

|

|

|

|

|

|

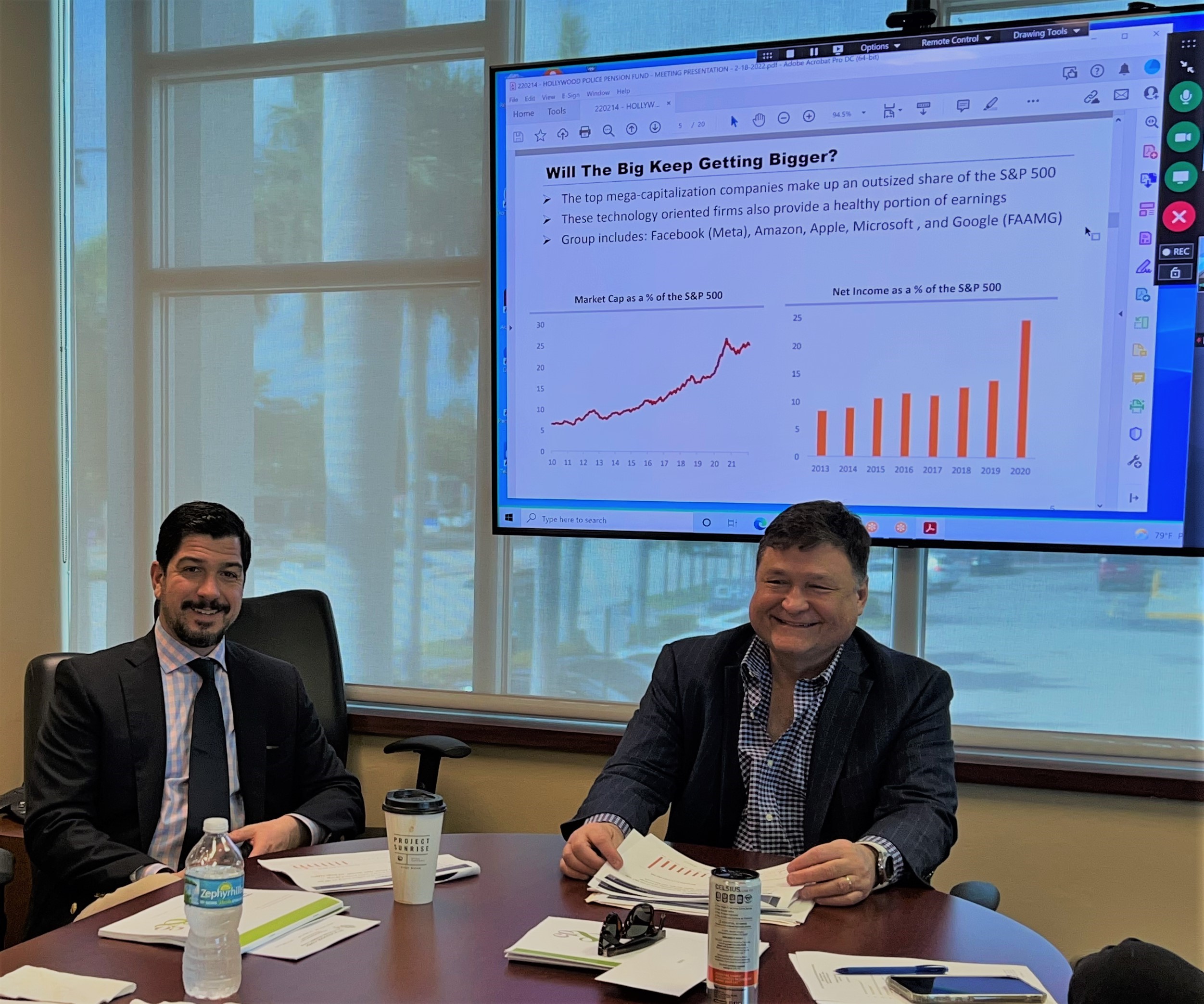

February 18th, 2022: Mr. Robert Maddock & Mr. Adrian Sancho of Inverness Counsel reported that for the fourth quarter of 2021, the portfolio returned 11.21%. On a rolling one year basis the return was 30.51%. The three & five year was 29.52% & 18.47% respectively.

|

|

|

|

|

|

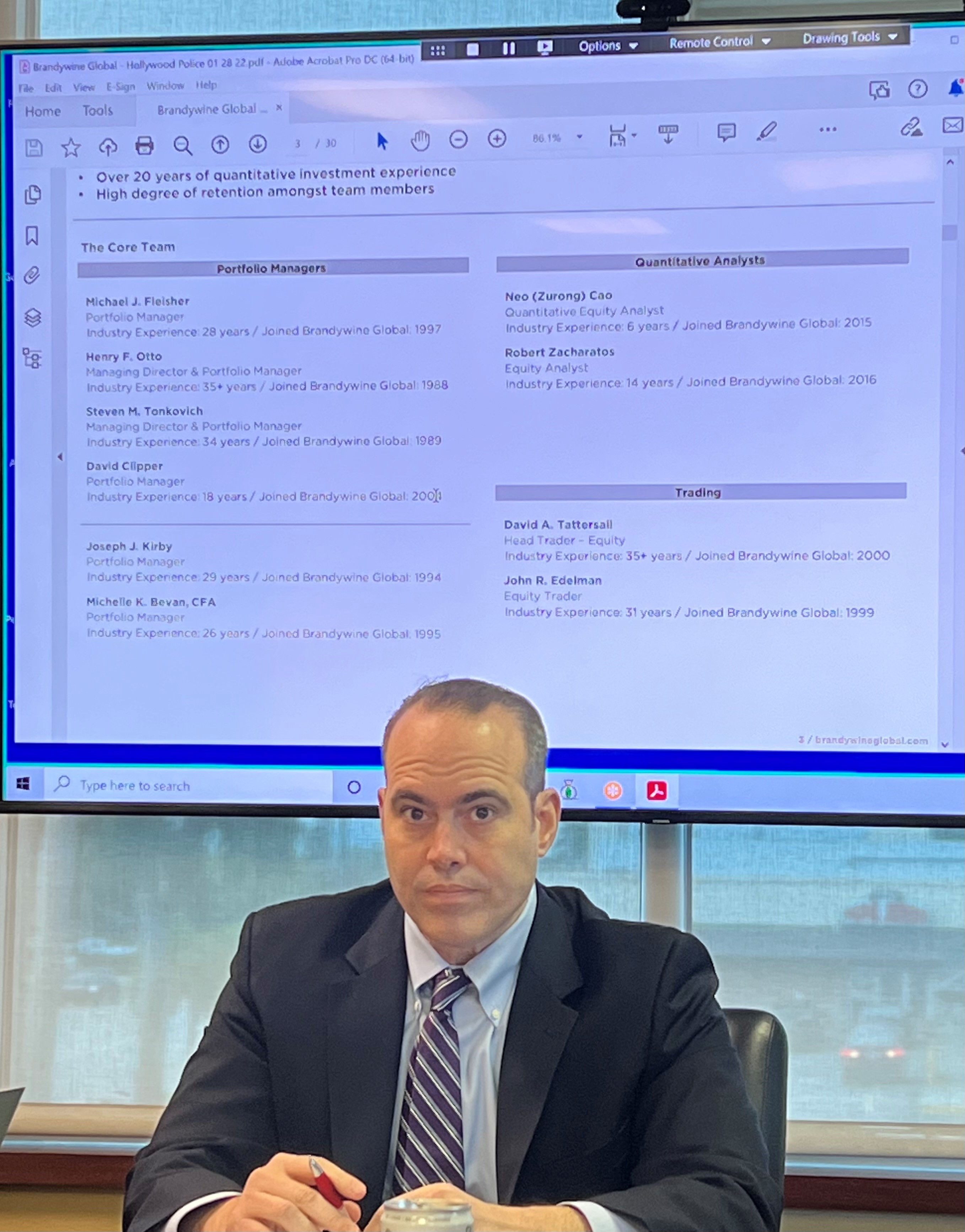

January 28th, 2022: This presentation was as a result of Mr. Boyd's request to further diversify our current asset class. Mr. Mark Juelis & Mr. Michael Fleisher (PICTURED) of Brandywine Global came before the Board to present Dynamic Large Cap Value Equity portfolio.

The portfolio was described as quantitatively driven equity strategies designed to deliver superior risk-adjusted returns. The portfolio managers were identified. It was reported the managers have over 20 years of quantitative investment experience. It was also noted that the portfolio has a high degree of retention amongst team members.

The Board engaged Brandywine Global to manage $16 million dollars of assets.

|

|

|

|

|

|

January 28th, 2022: Mrs. Crystal Wamble appeared before the Board and stated the market value of Eagle Account was at $20,130,431.00 as of December 31, 2021. Since inception (01-08-03) the Eagle Small Cap Account has realized an annualized net return of 11.02%, compared to the Russell 2000 of 11.21%.

|

|

|

|

|

|

November 19th, 2021: The Board of Trustees congratulated Mr. John McCann (the Board's Investment Consultant) on his retirement in December 2021. At the same time we welcome Brendon Vavrica, who will have a seamless transition as the Plan's new Investment Consultant. Best of Luck to Brendon and John!!

|

|

|

|

|

|

February 19th, 2021: Mr. Stephen Atkins and Mr. Anthony Xuereb of Polen Capital Of Boca Raton presented a portfolio strategy to the Board of Trustees to consider.

|

|

|

|

|

|

July 31, 2020: Matt Williams, Crawford Investment Counsel reviewed the performance for June 30, 2020.

|

|

|

|

|

|

February 21, 2020: Representatives from AndCo Consulting, Mr. John McCann and Ms. Jennifer Gainfort presented the December 31, 2020 quarterly investment report to the Board of Trustees. On the one, three and five year basis, the Fund returned 20.64%, 10.33% and 8.20% respectively. Those returns surpassed the investment benchmark for the Fund on all timelines.In a spirit of transparency the Board of Trustees continue to post the entire investment report on-line. To review the December 31, 2019 please click on the following link: 2019/12/31 Investment Report.

|

|

|

|

|

|

December 17, 2019: The Board of Trustees welcome our most recent hired officers who received their pension orientation at the Office of Retirement today. We wish them all many safe and rewarding years of service. They were also warmly greeted by K9 Cadet Koda Bear, the office mascot.

|

|

|

|

|

|

December 17, 2019: The Board of Trustees welcome our most recent hired officers who received their pension orientation at the Office of Retirement today. We wish them all many safe and rewarding years of service. They were also warmly greeted by K9 Cadet Koda Bear, the office mascot.

|

|

|

|

|

|

August 14, 2019: Dave Williams met with a new hire class to discuss the pension system. Pictured L-R: Officers Bradley Willis, Kyle Otwell, Carlos Posada, Brian Bermudez, Bryan Rodriguez-Diaz, Nicholas Kaplan and Alix Jean-Baptiste. The Board of Trustees Welcome You!

|

|

|

|

|

|

November 15, 2018: Adrian Sancho & John Rochford of Inverness Counsel, LLC. presented the September 30, 2018 report to the Board. For the fiscal year, the equity portfolio returned a stellar 21.30% compared to the benchmark which returned 17.91%. Keep up the great work!

|

|

|

|

|

|

September 28, 2018: Mr. Peter Hapgood of Intercontinental Real Estate Corporation appeared before the Board to provide an investment portfolio update. Account balance as of September 30, 2018 was valued at $21,674,520.00. With an inception date of May 22, 2013 through June 30, 2018 the return was valued at 12.73% (income and appreciation on a net basis).

|

|

|

|

|

|

September 28, 2018: Ms. Richelle Hayes of American Realty Advisors provided a portfolio update. With an inception date of April 1, 2013 through June 30, 2018 the return was valued at 10.27% (income and appreciation on a net basis).

|

|

|

|

|

|

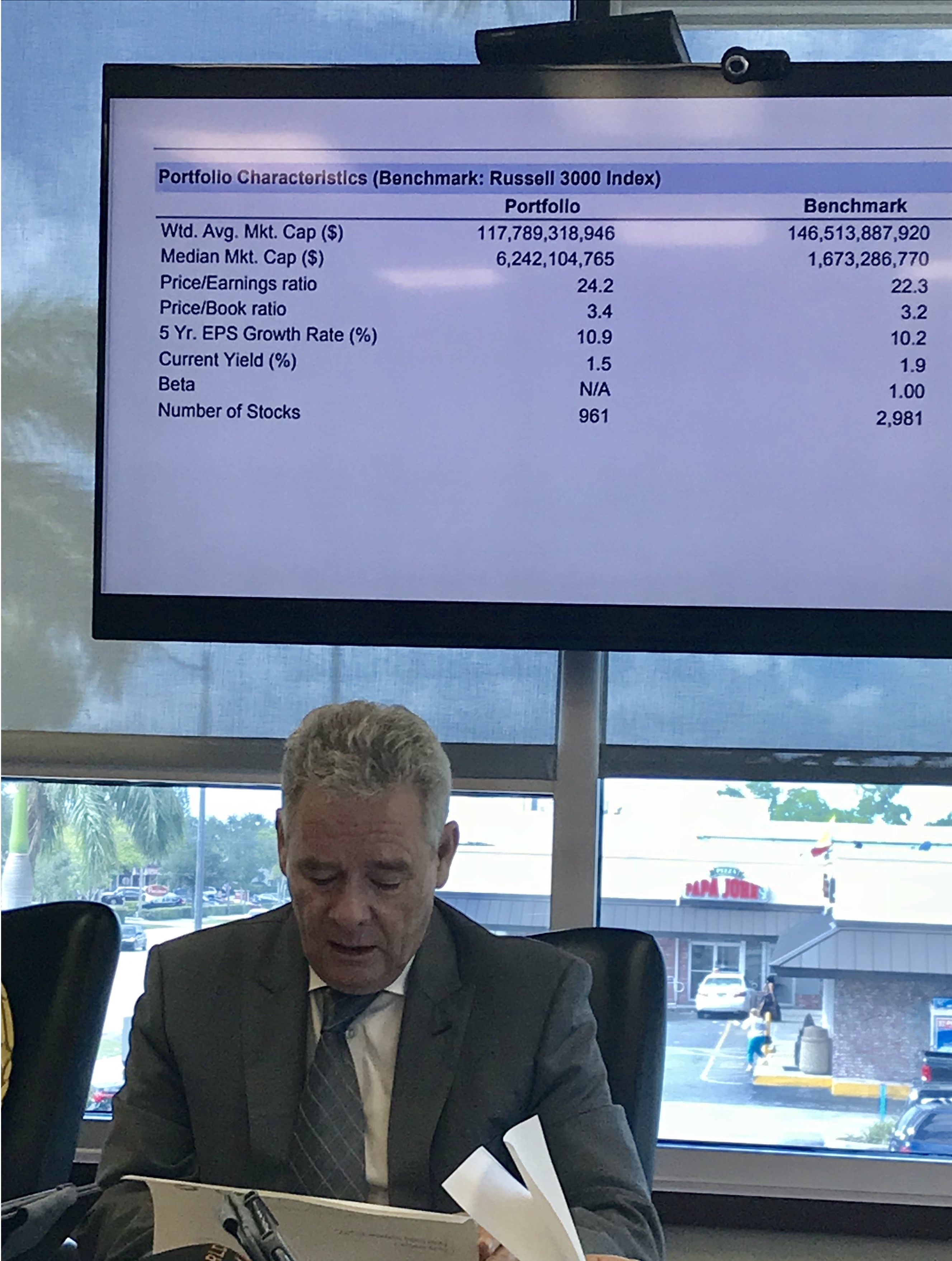

September 28, 2018: Mr. Brian O'Sullivan of Wells Fargo appeared before the Board to provide an investment portfolio update. The portfolio was valued at $19,792,538.26 as of August 31, 2018. Out performance versus the Russell 1000 Value Index year to date through August 31, 2018. 7 of 11 sectors contributed to that performance.

|

|

|

|

|

|

June 29, 2018: The Board of Trustees sent notice to the City of Hollywood and were poised to take action to reverse the unlawful passage of the 2011 police pension ordinance. The Florida Supreme Court ruled on the Headley case and the city's action was also ruled on by PERC, via the Hearing Officer's Recommended Order. Mr. Stuart Kaufman, Board Attorney (pictured) outlines a recent 3rd DCA ruling that has temporarily given reason to pause.

City of Miami, Appellant vs. City of Miami Firefighters' and Police Officers' Retirement Trust & Plan, et al., Appellees.

|

|

|

|

|

|

February 16, 2018: Mr. Todd Green and Mr. Joey Walls of Cavanaugh Macdonald Consulting, LLC presented the impact statement to roll back the city ordinance of 2011 as a result of Headley v. City of Miami. The report findings cited the following: The actuarial impact to the City of Hollywood Police Officers' Retirement System ("System") of proposed benefit changes. The proposed changes would retroactively restore the benefit structure in effect on September 30, 2011 immediately for all active members, deferred vested members, retirees and beneficiaries of the System.

|

|

|

|

.jpg) |

|

December 15, 2017: Mr. Matthew Orton, Product Specialist from Clarivest presented their inaugural quarterly report since being retained as one of three managers in the Large Cap Growth Equity Space. Clarivest replaced Garcia Hamilton after they closed out their equity product. Investing in underappreciated growth was the theme of the presentation.

|

|

|

|

|

|

December 15, 2017: Mr. Gregg Gosch, Institutional Client Service & Mr. Anthony Brooks, Equity Portfolio Analyst made their first appearance before the Board of Trustees since Sawgrass Asset management was retained in June 2017. Sawgrass was one of three managers retained after Garcia Hamilton closed their large cap growth equity product. The assets were diversified between two active managers and a passive index manager. Its reviewed by the representatives were: Account & Performance Review, Market Review, Current Portfolio Positioning and Looking Forward.

|

|

|

|

|

|

December 15, 2017: Mr. Gregg Gosch, Institutional Client Service & Mr. Anthony Brooks, Equity Portfolio Analyst made their first appearance before the Board of Trustees since Sawgrass Asset management was retained in June 2017. Sawgrass was one of three managers retained after Garcia Hamilton closed their large cap growth equity product. The assets were diversified between two active managers and a passive index manager. Its reviewed by the representatives were: Account & Performance Review, Market Review, Current Portfolio Positioning and Looking Forward.

|

|

|

|

|

|

November 17, 2017: John McCann (pictured) from AndCo Consulting presented the September 30, 2017 Investment Report to the Board of Trustees. The account balance was valued at $274,738,656. Broken down, $166,530,081 is domestic equities, $70,022,559 is fixed income, $28,700,466 in real estate and the balance is held in cash. The Fund exceed 11.00% on a fiscal year basis which exceeded the assumed rate of return. The Board of Trustees invite you to view investment reports back to 2001 on-line on our Investments Page.

|

|

|

|

.jpg) |

|

November 17, 2017: Janna Hamilton and the firm of Garcia Hamilton & Associates (GHA) of Houston, Texas was presented with a token of appreciation from the Board of Trustees for managing the Fund's Large Cap Growth Portfolio for the last 17 years. The GHA equity account was closed, but GHA still manages a portion of the Fund's fixed income portfolio.

|

|

|

|

|

|

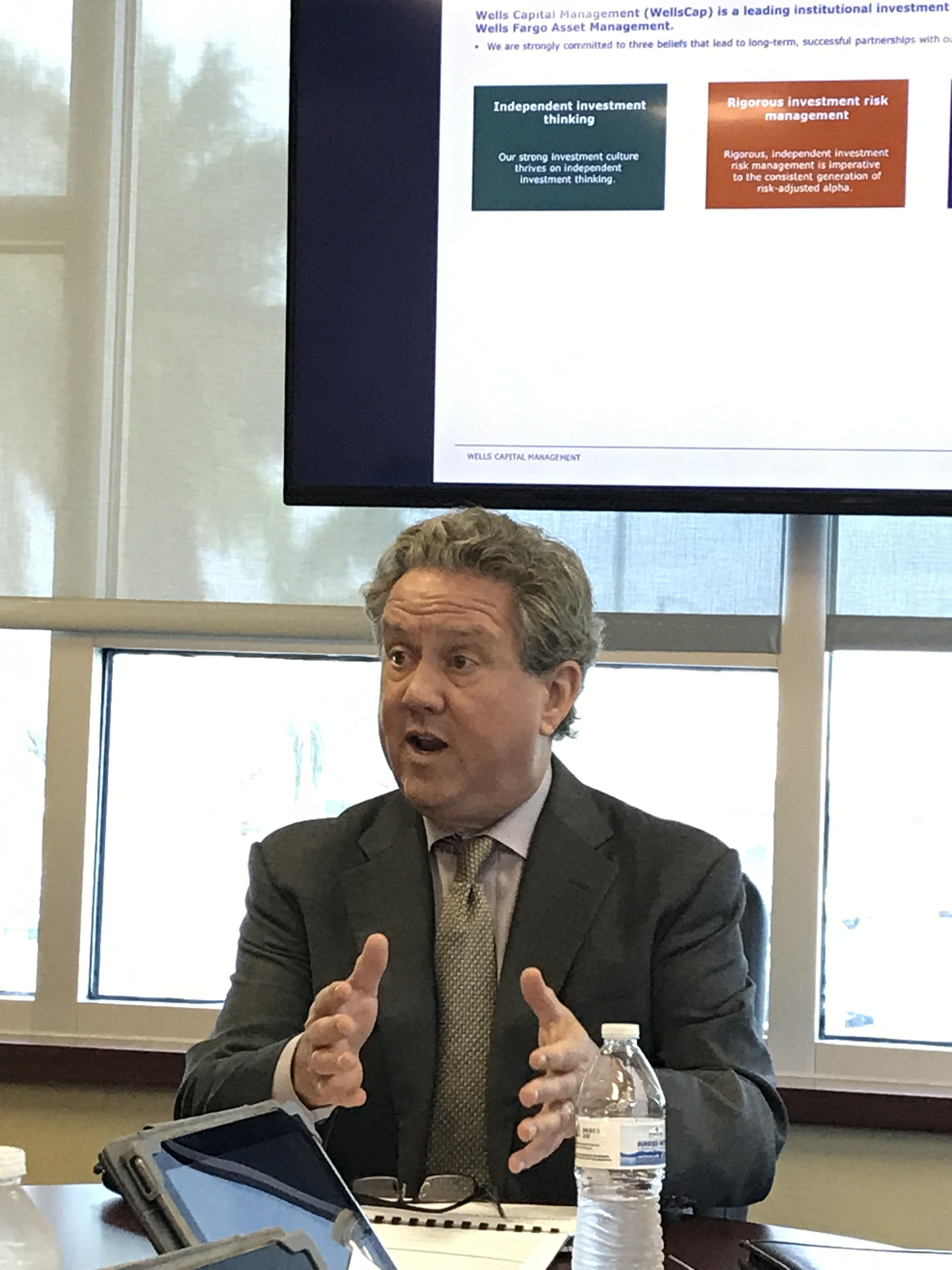

September 29, 2017: Brian J. O'Sullivan of Wells Capital Management provided the Board of Trustees a portfolio update on September 29, 2017. Solid absolute and relative performance versus the Russell 1000 Value Index year to date. Year to date through August 31, 3017, 7 of 11 sectors contributed to relative performance strength. Cloud thesis is bearing fruit for IT investments. Consumer Discretionary detracted due to the Amazon distortion field. Trailing one-year period, 7 of 11 sectors contributed to outperformance. Health Care and Information Technology contributed. CIGNA benefitted from cancellation of merger deal with Anthem. Some IT investments close to intrinsic value may provide opportunities to reduce allocation risk. Financials detracted. Underweight in Financials in a rising rate environment is a risk we are evaluating.

|

|

|

|

|

|

September 29, 2017: Adrian Sancho & John Rochford of Inverness Counsel, LLC. presented the September 30, 2018 report to the Board. For the fiscal year, the equity portfolio returned a stellar 21.30% compared to the benchmark which returned 17.91%. Keep up the great work!

|

|

|

|

|

|

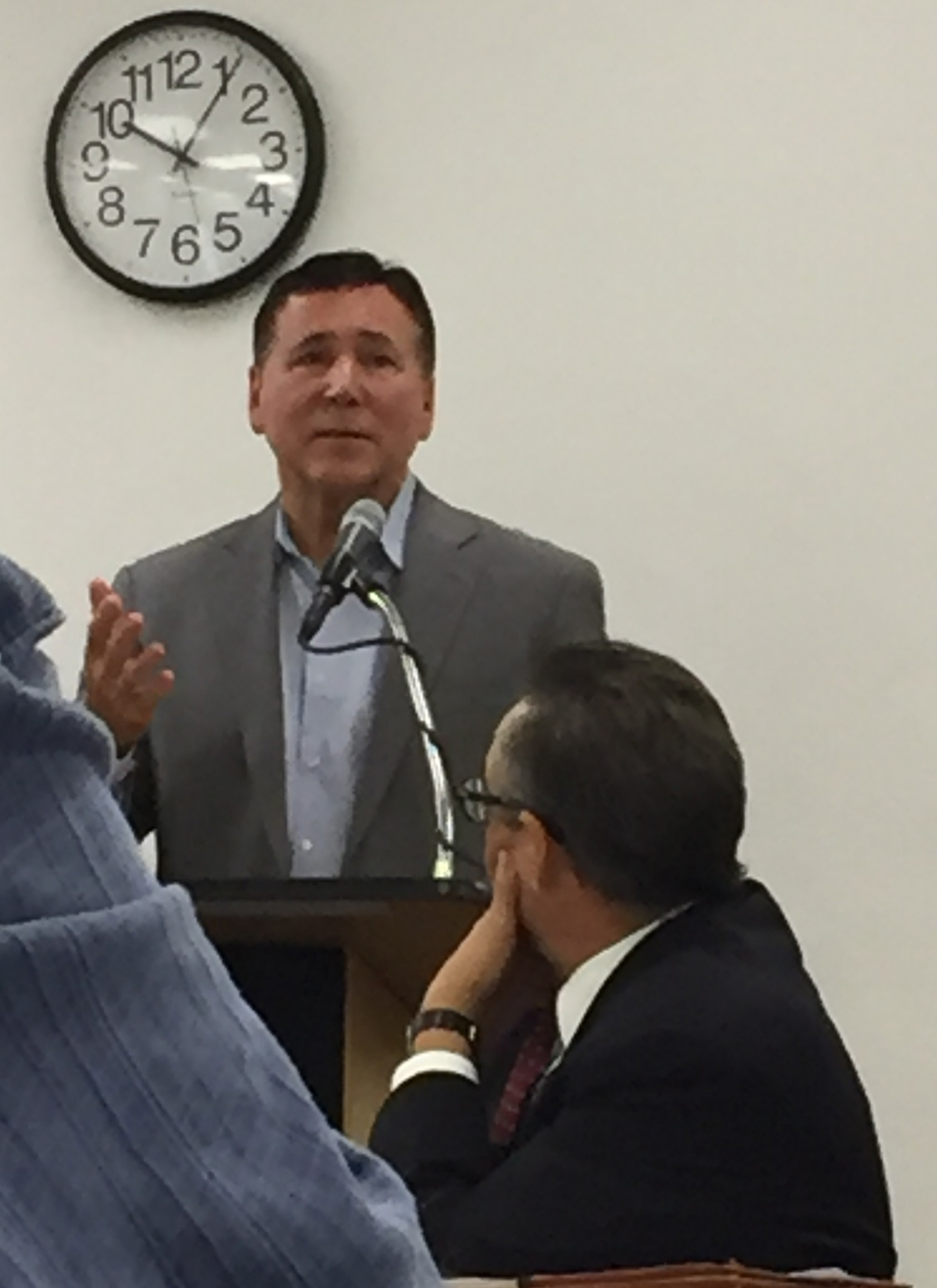

June 16, 2017: Mr. George Keller, Assistant City Manager - City Of Hollywood addresses the audience at the Mediation Meeting regarding the Supplemental Distribution Litigation.

|

|

|

|

|

|

March 13, 2017: Attorney Robert Klausner spoke at two pension informational sessions March 9th and March 13th, 2017.

Topics covered were:

Pension world overview and how our plan compares

DB vs DC (why Jacksonville will fail)

Does funding ratio matter - ARC

13th check lawsuit

185 Funds

Our referendum lawsuit & how it ties to (Headley v Miami case)

Pension Task Force

Membership Q & A

Approximately 90 officers attended over the two evening sessions. The Board of Trustees would like to "Thank" Robert Klausner for his assistance.

|

|

|

|

|

|

March 9, 2017: Attorney Robert Klausner spoke at two pension informational sessions March 9th and March 9th, 2017.

Topics covered were:

Pension world overview and how our plan compares

DB vs DC (why Jacksonville will fail)

Does funding ratio matter - ARC

13th check lawsuit

185 Funds

Our referendum lawsuit & how it ties to (Headley v Miami case)

Pension Task Force

Membership Q & A

Approximately 90 officers attended over the two evening sessions. The Board of Trustees would like to "Thank" Robert Klausner for his assistance.

|

|

|

|

|

|

January 27, 2017: Mr. Mark A. Guariglia & Mr. Bryan Schneider of EntrustPermal appeared before the Board to provide an investment update. It was reported that the account was valued at $4,786,052. as of December 31, 2016. Since the inception date was July 31, 2015 the net rate of return for the was valued at -4.28%. This is relatively a short-term horizon and over the longer term, performance will continue to improve.

The representatives reminded the Trustees that EnTrustPermal is one of the world's largest global hedge fund businesses. That EnTrustPermal leverages its position as a global top five hedge fund investor to negotiate even lower fees and better terms with our underlying managers on behalf of our investors.

Activist strategies range from "constructivism", where the activist managers work collaboratively with the company's management team, to aggressive activism, where managers employ a variety of hostile techniques that include replacing management teams and boards. |

|

|

|

|

|

January 27, 2017: Mr. Rick appeared before the Board and stated the market value of Eagle Account was at $23,829,029 as of December 31, 2016. Since inception (01-08-03) the Eagle Small Cap Account realized an annualized gross return of 12.02%, compared to the Russell 2000 of 10.72%.

For the quarter ending December 31, 2016, Eagle Small Cap Account returned 7.00%, compared to 8.83% for the Russell 2000. On a one year rolling basis, the portfolio returned 22.55% compared to the benchmark of 21.31%. The 3 & 5 Year returns were valued at 9.85% & 15.24% in comparison to the benchmark returns of 6.74% & 14.46% respectively.

Mr. Rick provided a market overview: The market saw a difficult start to the year as falling oil prices, fears of faltering growth, and a sharp depreciation of China's currency slammed the value end of the market. The pain was surprisingly short-lived and from March to December it was generally a value led market.

Contributors to relative performance: Health Care - Healthcare outperformed this quarter due to selection effect. Biotechnology and pharmaceuticals holdings outperformed while being underweight the index.

Detractors from relative performance: Real Estate - Eagle continues to find growth utilities and growth REITs to be the most attractive, since the yield, not future opportunities dominate total valuations in these spaces. |

|

|

|

|

|

February 22, 2017: The Board of Trustees administered a pension election from February 15th at 9:00 AM thru February 22nd at 9:00 AM. The election was for three seats.

The results were tallied today as follows:

|

| MEMBER |

|

VOTES

RECEIVED |

|

| Christopher Boyd - WON |

|

187 |

| Rhett Cady |

|

69 |

| Luis Ortiz |

|

73 |

| David Strauss WON |

|

214 |

| Van Szeto - WON |

|

190 |

|

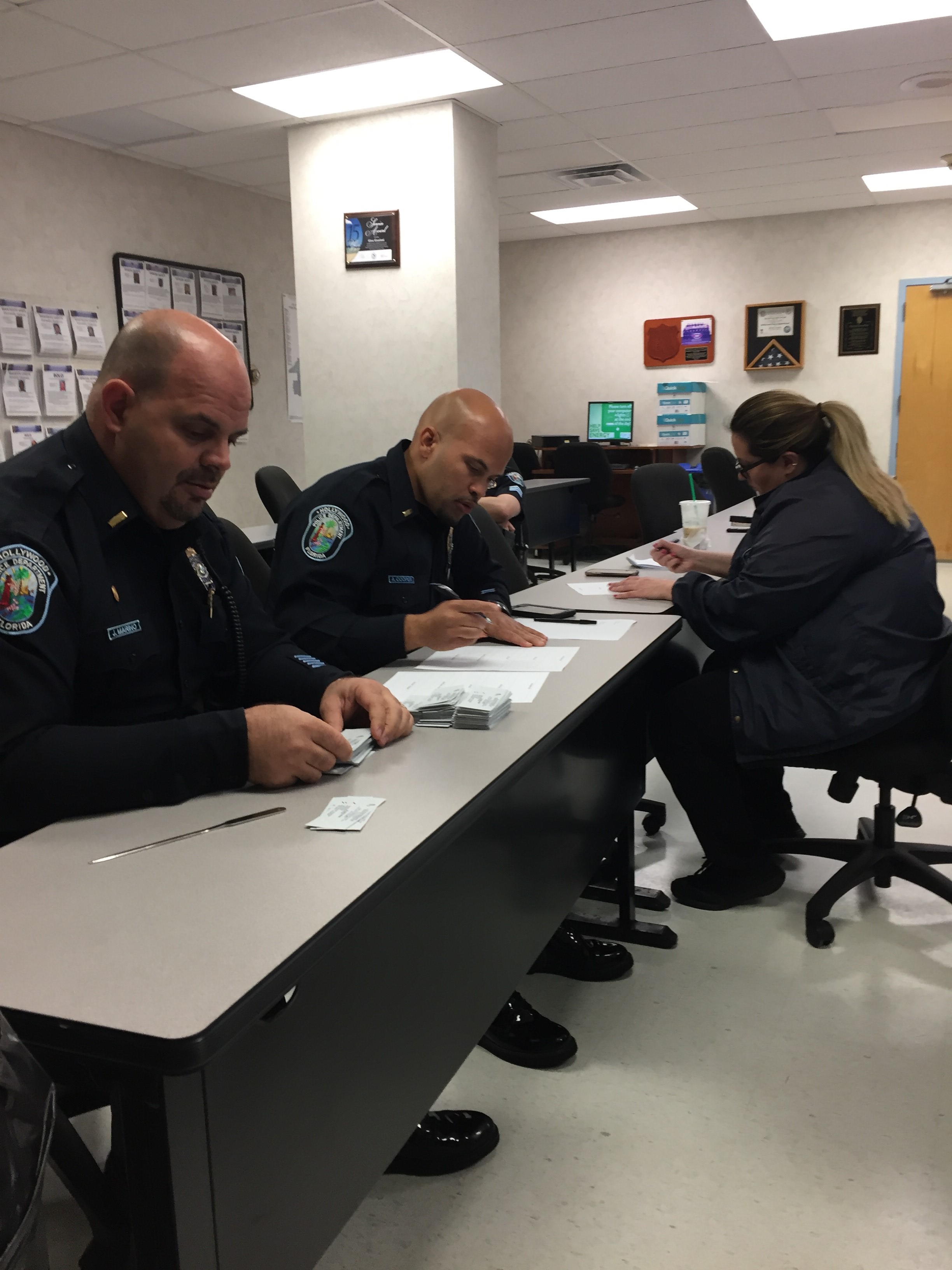

(Pictured above) Members counting the ballots in a spirit of open government and transparency.

The Board would like to thank all of the members that ran for the open seats and those members who took the time to vote!

|

|

|

|

|

|

February 17, 2017: After faithfully serving on the Board of Trustees since 2009, Chris O'Brien decided not to seek re-election. Chris (pictured center) was honored at his last pension meeting by his fellow Trustees. Thank you for your service Chris! |

|

|

|